India’s economic growth probably matched government estimates as demand spurred an expansion in the service sector and cushioned the impact of elevated interest rates.

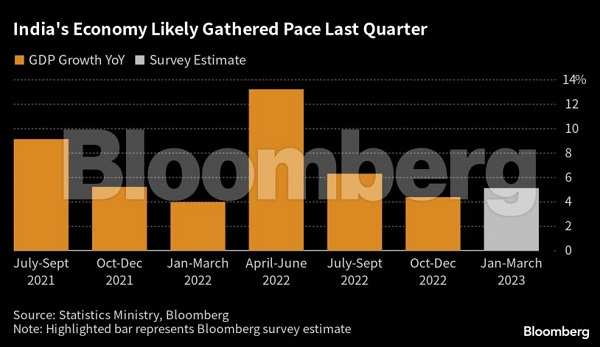

Data due Wednesday is likely to show gross domestic product in the year to March 2023 grew 7%, according to the median estimate in a Bloomberg survey that’s in line with a government forecast made three months ago. While this is slower than the previous fiscal year’s expansion of 9.1%, India is still recording one of the fastest growth rates among major world economies.

The survey showed Asia’s third-biggest economy probably grew 5% in January to March, from a year ago. While this is an acceleration from the previous quarter, uneven monsoon rains and an emerging global slowdown may put a spanner in the works.

“High frequency indicators showed improvement in the last quarter,” said Abheek Barua, chief economist at HDFC Bank. “Corporate margins grew, government investment activity remained strong, especially in construction of roads, consumption demand kept steady amid slightly lower inflation level.”

India’s resilient growth could reassure the central bank that its monetary tightening hasn’t taken a big toll on the economy and give it more room to pause for a second straight meeting on June 8. This is an outcome predicted by economists in a Bloomberg survey.

Reserve Bank of India Governor Shaktikanta Das floated the possibility last week that the previous year’s growth could be more than 7% as data showed momentum in the latest quarter. He warned that the war against inflation isn’t over yet and the current hold on rates was more of a pause than a pivot.

Inflation slowed to 4.7% in April after staying above the RBI’s target ceiling of 6% for much of the last fiscal year. That’s raising hopes for market watchers that borrowing costs won’t go up from here, supporting consumption and investment before national elections next summer.

The yield on benchmark 10-year bond has dropped below 7% from its June high of 7.6%, while the benchmark stock index is hovering around its all-time high amid continued purchases from foreign investors.

Service Sector Support

Service sector have emerged as a key growth driver, comprising more than half of the nation’s GDP. India has been gaining market share in information technology and business consulting work, boosting services activity to the highest in almost 13 years.

The data may show trade, hotel and transportation and government expenditure picked up pace in the last quarter, according to Gaura Sen Gupta, an economist at IDFC First Bank. Consumption in the urban areas likely remained healthy on formal sector job creation, while rural demand could be showing “nascent sign of recovery” led by increase in wages, she said.

“1Q23 growth looks likely to come in faster than we have expected due to a combination of a favorable harvest, government subsidies that are boosting manufacturing, and stronger service exports underpinned by multinationals shifting back-office business to India.”

The Finance Ministry’s top economic adviser told Bloomberg last week that strong credit demand and softening crude oil prices could buoy the economy, putting India on course for a 6.5% expansion this fiscal year that started April 1. The International Monetary Fund pegs it even lower at 5.9%, but the prospects are still better than China that is expected to show a growth of 5.2% in 2023.

There are signs of goods exports slowing but a bigger blow for India could come from inadequate rains for crops such as rice, corn and soyabeans, which will slow the rural economy that makes up about half of the nation’s GDP.

Growth will likely slow down next year due to the lagged impact of monetary policy tightening, intensification of a global growth slowdown, and fading domestic demand, said Kaushik Das, chief economist, India and South Asia, Deutsche Bank AG. “The government’s push for public investment and any incremental pick-up in private capex investment could help support growth,” he said.

Also read: Wrestlers Postpone Sinking Medals in Ganges in India