The Rs 2000 banknote was introduced in November 2016 under Section 24(1) of the RBI Act, 1934 — which allows the central bank to issue notes of any denomination not exceeding Rs 10,000 — primarily to meet the currency requirement of the economy “in an expeditious manner” after the big demonetisation exercise, in which the legal tender status of all Rs 500 and Rs 1,000 banknotes in circulation at that time was withdrawn, the Reserve Bank of India has said.

“With fulfilment of that objective and availability of banknotes in other denominations in adequate quantities, printing of Rs 2000 banknotes was stopped in 2018-19,” RBI said.

RBI Governor Shaktikanta Das today said the exercise is part of the “currency management system” of the central bank, and “there’s no reason to rush to banks” as people have four months to change or deposit Rs 2000 notes.

Mr Das said the bank expects most notes to come back. “We will decide what to do next after September 30. But it will continue as legal tender,” he said and assured the people, even those living in foreign countries, that the RBI will be sensitive to all their problems.

Rs 2,000 notes in numbers

A majority (89 per cent) of the Rs 2000 notes were issued before March 2017, and are at the end of their estimated life span of four to five years, the central bank said, highlighting that Rs 2,000 notes are not commonly used for transactions.

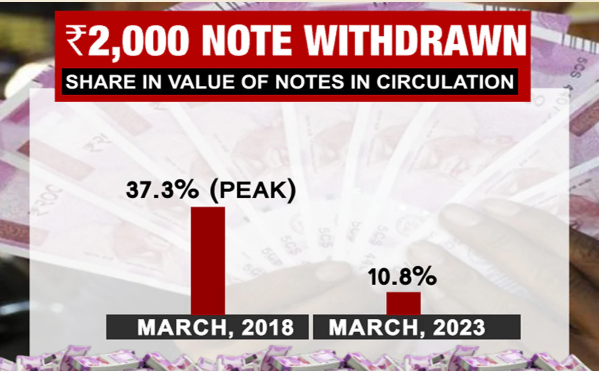

“The total value of these banknotes in circulation has declined from ₹ 6.73 lakh crore at its peak as on March 31, 2018 (37.3% of Notes in Circulation) to ₹ 3.62 lakh crore constituting only 10.8% of Notes in Circulation on March 31, 2023,” RBI said.

In absolute numbers, there were 274 crore Rs 2000 notes in circulation in 2020, comprising 2.4 per cent of total currency notes, which declined to 245 crore in 2021 (2 per cent) and further dipped to 214 crore in 2022 (1.6 per cent).

RBI also has adequate stock of banknotes in other denominations, it said.

What is the “Clean Note Policy”

Rs 2000 notes have been withdrawn under the central bank’s “Clean Note Policy”.

The objective of RBI’s “Clean Note Policy”, introduced in 1999, is to provide good quality currency notes and coins while the soiled notes are withdrawn out of circulation. The Reserve Bank had then instructed the banks to issue only good quality clean notes to the public and refrain from recycling the soiled notes received by them over their counters.

Several other steps were taken, including directing banks to do away with stapling of note packets and to introduce banding the packets with paper/polythene bands so that the life of the currency notes is increased. People were also urged not to write on the currency notes, and banks were instructed to provide unrestricted facilities for the exchange of soiled and mutilated notes. As per the Reserve Bank instructions, currency chest branches of the banks must offer, even to non-customers, good quality notes and coins in exchange for soiled and mutilated notes.

How the exchange facility will work

India’s biggest public bank, the State Bank of India, yesterday clarified that no form or slip would be required while exchanging or depositing ₹ 2000 notes.

Government sources have said people can exchange ₹ 2000 rupee notes up to ₹ 20,000 any number of times in a day. A person has to stand in a queue, and they can keep coming back and stand in the same queue after exchanging the money, they said. The upper limit of ₹ 20,000 is to ensure operational convenience and to avoid disruption of regular activities of bank branches.

The exchange facility begins on May 23 and will continue till September 30. The RBI may extend the deadline to exchange or deposit the notes from September 30 if needed, but even if anyone has a ₹ 2,000 note after the current deadline, it will remain a valid tender, sources told NDTV.

On the decision to set September 30 as the deadline, the RBI Governor said people wouldn’t have taken it seriously and exchanged notes if they hadn’t specified a time.

It is not necessary for a person to be a customer of a bank to exchange the soon-to-be-discontinued currency with them.

RBI’s instructions to banks

The RBI clarified that people don’t have to pay any fee to avail of the exchange facility. Further, banks have been instructed to make arrangements to reduce inconvenience for senior citizens and persons with disabilities who wish to exchange or deposit ₹ 2,000 banknotes.

In a fresh circular to banks today, RBI has directed them to maintain daily data on deposits and exchange of ₹ 2,000 notes in a simple, fixed format. It has also asked them to provide facilities like shaded waiting spaces, and drinking water to customers, considering summer.